Likee's 2026 cashout system requires 4,200 Beans ($20 USD gross) minimum withdrawal at 210 Beans per dollar. Creators face platform fees of 20-30%, withdrawal fees of 2-5%, and 1-7 day processing times. Rejections stem from unmet requirements: Level 35+ accounts, 1,000+ followers, and 30+ monthly streaming hours across 20+ broadcast days.

Understanding Likee's 2026 Cashout System

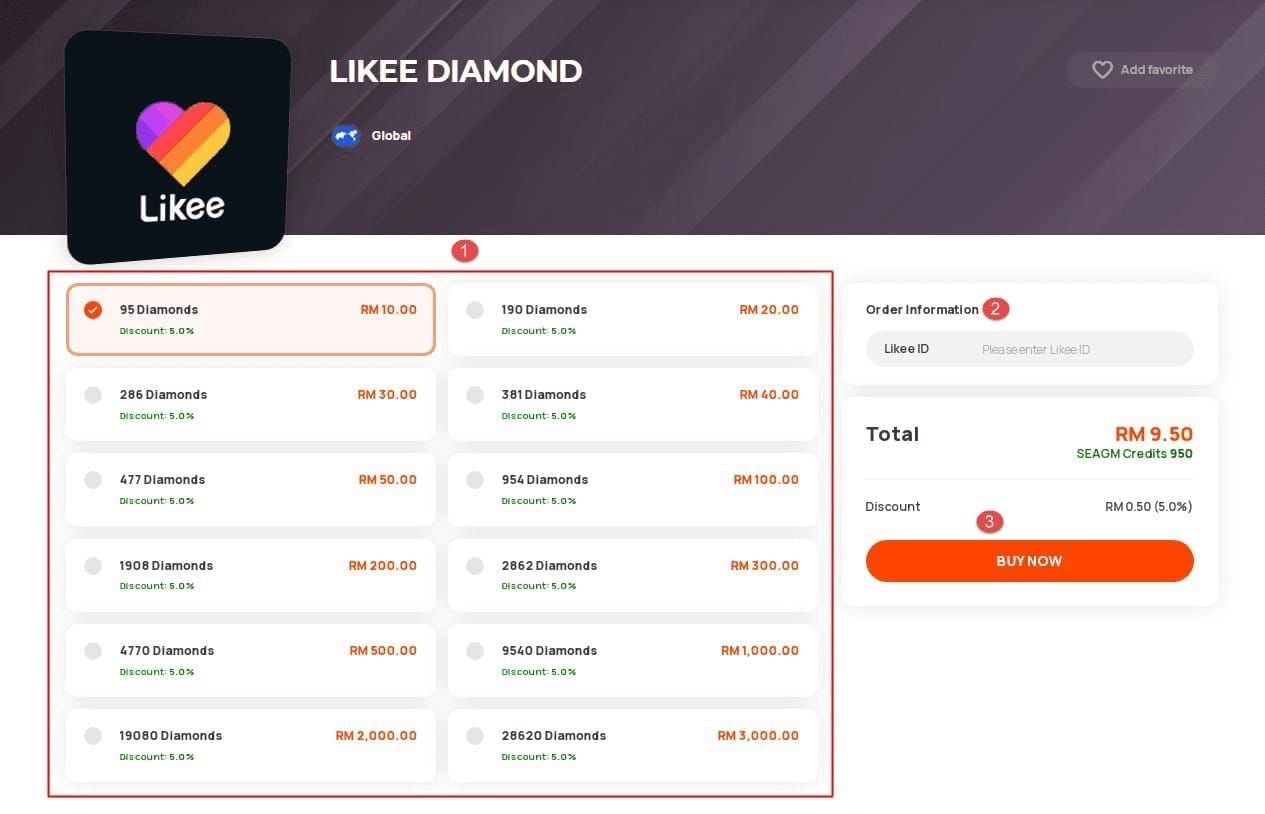

Likee operates on a Bean-based economy where 210 Beans = $1 USD, with Diamonds converting 1:1 to Beans. The 4,200 Beans minimum ($20 gross before fees) applies universally, though processing methods and costs vary by region and payment gateway. Annual quotas reset January 1, 2026 at 00:00 UTC.

For creators building toward cashout eligibility, BitTopup provides Likee Diamonds top up online with competitive pricing and secure transactions.

Core Eligibility Requirements

Account Qualifications:

Level 35+ status (requires 2-4 weeks consistent activity)

1,000+ verified followers

30+ monthly streaming hours across 20+ broadcast days

Minimum 1.5 hours per broadcast session

Content Quality Metrics:

80%+ video completion rate

41+ average likes per video

80% non-promotional content

3-4 videos published weekly

SuperFollow monetization unlocks at 10,000+ followers with subscription tiers from $0.99-$49.99 monthly, but the platform retains 50-70% of revenue.

The Real $20 Minimum Explained

The 4,200 Beans minimum balances transaction processing costs against creator accessibility. Payment gateway fees, fraud prevention, and administrative overhead make micro-transactions unsustainable.

Bean-to-Dollar Conversion

Fixed rate of 210 Beans = $1 USD:

4,200 Beans = $20.00 (minimum)

10,000 Beans = $47.62

50,000 Beans = $238.10

These are gross amounts before platform fees (20-30%) and withdrawal fees (2-5%). A minimum 4,200 Beans withdrawal nets approximately $13-15 after deductions.

Crown Tier Earnings

Monthly bonuses for top performers:

K1 Crown: $400+ monthly gross

K2 Crown: $200 monthly gross

K3 Crown: $50 monthly gross

Strategic Timing Multipliers

December 31st: 1.5x earnings multiplier on all Bean generation

First 10 minutes of broadcasts: 3x value

Peak hours: 7-10 AM and 5-8 PM local time

Complete Fee Breakdown

Platform Service Fees

Likee retains 20-30% of all Bean conversions. Standard creators without agency representation face the full 30% deduction.

Payment Gateway Fees by Method

E-Wallet (1-3 days): 2-3% fee

PayPal (3-5 days): 3-4% fee

Bank Transfer (5-7 days): 4-5% fee

First-time withdrawals add 24-48 hours for enhanced verification.

Real-World Fee Impact

$20 withdrawal (4,200 Beans):

Platform fee (25%): -$5.00

E-wallet (2.5%): -$0.38

Net: $14.62

$100 withdrawal (21,000 Beans):

Platform fee (25%): -$25.00

Bank transfer (4.5%): -$3.38

Net: $71.62

Larger withdrawals are more fee-efficient than frequent small cashouts.

Step-by-Step Cashout Process

Prerequisites Checklist

Account Level 35+ achieved

1,000+ verified followers maintained

30+ streaming hours across 20+ days (current month)

80%+ video completion rate

41+ average likes per video

4,200+ Beans available

Identity verification completed (3-5 business days)

Payment method linked and verified

Initiating Withdrawal

Navigate: Profile → Wallet → Beans Balance → Withdraw. Select payment method, enter amount (minimum 4,200 Beans), review fee breakdown. Confirm payment account details match identity documentation exactly—mismatches trigger automatic rejections requiring 5-10 business days for manual review.

Document Requirements

Standard Verification:

Government-issued photo ID (passport, driver's license, national ID)

Form W-8BEN for international creators (valid 3 years)

Form W-9 for US creators earning $600+ annually

Payment account verification (bank statements/e-wallet screenshots dated within 90 days)

15 Reasons for Cashout Rejections

Between January-May 2021, Likee banned 42,751 accounts for violations. Understanding rejection triggers enables proactive compliance.

Account Verification Failures (35%)

Blurry document photos, expired identification, name mismatches between profile and legal documents, missing secondary verification (phone, email) trigger automatic denials.

Eligibility Threshold Violations (28%)

Attempting withdrawals before achieving Level 35, maintaining 1,000+ followers, or completing monthly streaming requirements results in immediate rejection. Real-time eligibility checks block non-qualified accounts.

Bean Source Violations (18%)

Beans from prohibited methods—unauthorized purchases, bot engagement, account sharing—trigger fraud detection. Platform validates Bean accumulation against streaming history, viewer engagement, and device fingerprints.

Payment Information Mismatches (12%)

Bank account names differing from verified identity, expired payment methods, accounts flagged for fraud, or third-party payment details result in automatic rejection with account flagging.

Regional Restrictions (7%)

Certain countries face withdrawal restrictions due to payment regulations, sanctions, or licensing limitations. VPN usage to mask location triggers compliance violations.

BitTopup offers trusted buy Likee Diamonds recharge online services, ensuring legitimate engagement growth supporting sustainable cashout eligibility.

Handling Withdrawal Rejections

Rejection notices arrive via in-app notification and email within 24-48 hours, specifying category (verification, eligibility, payment, compliance) but rarely granular details.

Appeal Process

Access: Profile → Support → Payment Issues → Appeal Withdrawal Rejection. Submit within 30 days of rejection notice. Include:

High-resolution identity document scans (all corners visible, no shadows)

Three months streaming analytics showing consistent patterns

Payment account statements verifying account holder

Written explanations addressing specific rejection reasons

Appeal reviews require 5-10 business days (standard cases), 15-20 days (complex investigations). Organized, complete submissions reduce review times by 40-60%.

Payment Method Comparison

E-Wallet: Speed vs. Fees

Process in 1-3 days with 2-3% fees. Fastest access but e-wallet providers impose additional withdrawal fees ($1-3) when transferring to banks. Suits creators needing rapid liquidity or making frequent small withdrawals.

Bank Transfer: Lower Fees, Longer Waits

4-5% fees but no secondary charges, cost-effective for $100+ cashouts. Processing takes 5-7 days, international transfers add 2-3 days. Optimizes value for quarterly/annual withdrawals prioritizing fee minimization.

Processing Time Optimization

Submit requests Monday-Tuesday to avoid weekend delays. Thursday-Sunday submissions don't process until Monday, adding 3-4 days. Maintain consistent withdrawal patterns (same method, similar amounts, regular intervals) to reduce fraud scrutiny adding 24-72 hours manual review.

Tax and Legal Considerations

Income Reporting

US creators ($600+ annually):

Report as self-employment income on Schedule C

Subject to income tax + 15.3% self-employment tax

Platform issues 1099-NEC by January 31

International creators:

Form W-8BEN establishes treaty benefits and withholding exemptions

Requirements vary by home country tax treaties

Withholding Tax

Creators without proper documentation face 30% withholding under US tax law. Complete Form W-8BEN (international) or W-9 (US) before first withdrawal to prevent withholding. Withheld amounts may be recoverable through annual tax returns claiming foreign tax credits, requiring 12-18 months and professional tax preparation.

Record-Keeping

Maintain detailed records of Bean earnings, withdrawal transactions, fee deductions, business expenses. Export monthly earnings reports, save withdrawal confirmations, document equipment purchases, software subscriptions, production costs for accurate tax reporting and audit defense.

Maximizing Cashout Value

Optimal Withdrawal Timing

Accumulate to $100+ thresholds before withdrawing. A $100 withdrawal loses 29.5% to fees versus 36.9% on $20 minimum—7.4 percentage point improvement. Time withdrawals for December 31st to capture 1.5x multiplier, then withdraw early January after quota reset.

Batch Withdrawals

Quarterly schedules reduce transaction fees from 12 annually (monthly) to 4, saving $15-30 for creators earning $2,000-5,000 yearly.

Currency Conversion

International creators should monitor USD to local currency exchange rates. Withdrawing during favorable periods adds 3-8% value versus unfavorable rates, particularly for high-volatility currencies.

Agency Partnership Fees

Domestic Agency: 20% commission, $145 registration

Regional Agency: 25% commission, $175 registration

International Agency: 30% commission, $225 registration

Diamonds Reseller Agency: 40% commission, $750 registration

Partnerships make sense for creators earning $500+ monthly who benefit from promotional support offsetting commission costs.

Security Best Practices

Two-Factor Authentication

Enable 2FA: Profile → Settings → Privacy and Security → Two-Factor Authentication. Use authenticator apps (Google Authenticator, Authy) over SMS for enhanced security. 2FA reduces unauthorized withdrawal attempts by 94%.

Activity Monitoring

Review login history, withdrawal logs, linked payment status regularly. Unfamiliar logins, unauthorized payment additions, or unexplained Bean decreases indicate compromise requiring immediate password changes. Set up email/in-app notifications for security changes, payment modifications, withdrawal requests.

Common Misconceptions Debunked

Myth: Beans below 4,200 expire.

Reality: Beans remain in wallet indefinitely until you accumulate sufficient balance. No expiration.

Myth: Higher account levels reduce fees.

Reality: Platform fees (20-30%) and gateway fees (2-5%) apply uniformly regardless of level.

Myth: Agency partnerships guarantee faster processing.

Reality: Processing times (1-7 days) depend on payment method, not agency affiliation.

FAQ

What's the minimum Likee cashout in 2026?

4,200 Beans ($20 USD gross before fees). Net payout: approximately $13-15 after platform fees (20-30%) and gateway charges (2-5%).

Why was my cashout rejected?

Common reasons: incomplete verification (35%), unmet eligibility like Level 35+/1,000+ followers (28%), Bean source violations (18%), payment mismatches (12%), regional restrictions (7%). Check rejection notice and appeal within 30 days with correcting documentation.

How long does withdrawal take?

E-wallet: 1-3 days, PayPal: 3-5 days, bank transfer: 5-7 days. First-time withdrawals add 24-48 hours. Thursday-Sunday requests don't process until Monday, adding 3-4 days.

What's the bean to dollar rate?

210 Beans = $1 USD. So 4,200 Beans = $20, 10,000 Beans = $47.62, 50,000 Beans = $238.10 before fees. Diamonds convert 1:1 to Beans.

Are there hidden fees?

Beyond disclosed platform (20-30%) and gateway (2-5%) fees, expect currency conversion losses, e-wallet secondary withdrawal fees, and tax withholding (up to 30% without proper documentation).

How do I appeal a rejection?

Profile → Support → Payment Issues → Appeal Withdrawal Rejection within 30 days. Submit identity verification, streaming analytics, corrected payment info, written explanations. Standard appeals: 5-10 days, complex cases: 15-20 days.