Poppo Live exchange rate arbitrage reveals significant regional pricing gaps. Philippines delivers 12,000+ coins per $1 USD via Google Play—beating Nigeria and Pakistan's 9,460 coins per dollar, Nepal's 8,900 coins, and the global baseline of 8,300-9,100 coins. This analysis examines verified pricing across regions, providing cost-conscious users actionable strategies to maximize coin purchasing power through legitimate regional pricing differences.

Understanding Poppo Live Exchange Rate Arbitrage

Exchange rate arbitrage leverages regional pricing differences on Google Play to acquire coins at lower costs. This capitalizes on purchasing power parity adjustments Google implements across markets, where identical coin packages carry vastly different local currency prices.

The mechanics: a 210,000 coin package costs PHP 989 (≈$17.40 USD) in Philippines, while the same value requires significantly more in global markets. Philippine pricing delivers 12,000+ coins per dollar versus the global benchmark of 9,460 coins—a 27% improvement.

For simplified access without regional complexity, Poppo Live Coins top up through BitTopup provides transparent pricing with instant delivery, eliminating VPN configurations or payment adjustments while maintaining competitive rates.

What Is Currency Arbitrage in Mobile Gaming

Currency arbitrage exploits price inconsistencies across geographical markets. Google Play adjusts pricing based on local economic conditions, average income levels, and competitive positioning. These adjustments create opportunities where identical digital goods cost different amounts when converted to common currency.

Key differences from traditional financial arbitrage:

Consumer-level transactions vs. institutional trading

Price differences from deliberate market segmentation vs. temporary inefficiencies

Requires navigating platform policies vs. sophisticated trading algorithms

Effective arbitrage requires more than price comparison. Transaction fees, currency conversion costs, payment method availability, and account restrictions all impact net savings. A 30% nominal advantage can evaporate when foreign transaction fees add 3-5% and currency conversion spreads consume another 2-4%.

Why Regional Pricing Exists on Google Play

Google implements regional pricing to maximize market penetration across economies with vastly different purchasing power. A $10 USD package represents significantly larger disposable income in developing markets versus Western economies, necessitating price adjustments.

This follows purchasing power parity principles, where prices reflect what consumers in each market can reasonably afford. Philippines pricing—packages starting at PHP 33 (≈$0.58 USD) for 7,000 coins—demonstrates this approach, offering entry points aligned with local economic conditions.

Platform holders also face competitive pressures within each market. Regional pricing allows Google Play to compete effectively against local payment platforms and alternative recharge methods dominating specific geographical areas.

Legal and Ethical Considerations

Regional pricing arbitrage occupies a gray area in platform terms of service. Google Play policies prohibit using VPNs to access content unavailable in your region or manipulate pricing, though enforcement varies. The platform primarily targets large-scale abuse rather than individual consumer purchases.

Legally, purchasing digital goods through legitimate payment methods rarely constitutes fraud, even when accessing different regional stores. However, platforms reserve the right to restrict accounts violating terms of service.

Ethical considerations center on whether exploiting regional pricing undermines the economic logic making content affordable in developing markets. Some argue arbitrage by wealthy-market users could prompt publishers to eliminate regional discounts, ultimately harming users in lower-income countries who genuinely need those price adjustments.

How Exchange Rates Impact Purchasing Power

Currency exchange rates directly determine USD-equivalent cost of regional purchases. The Philippine peso typically trades around 56-58 PHP per USD, meaning the 21,000 coin package at PHP 99 costs ≈$1.74 USD—delivering roughly 12,069 coins per dollar.

Exchange rate volatility introduces timing considerations. A 5% currency fluctuation can amplify or diminish arbitrage advantages. When the peso strengthens against the dollar, Philippine packages become relatively more expensive for USD holders. Conversely, peso weakness enhances the arbitrage opportunity.

Real-world calculations must account for the complete transaction chain. If your credit card charges 3% foreign transaction fee and payment processor applies 2% currency conversion markup, your effective exchange rate differs substantially from mid-market rate. A package nominally costing $17.40 might actually charge $18.27 after fees—reducing coins-per-dollar from 12,069 to 11,504.

Complete Regional Price Comparison: Verified Data

Comprehensive pricing analysis across regions reveals distinct tiers of coin affordability. As of October 2025, Philippines consistently offers highest coins-per-dollar ratio, followed by Nigeria and Pakistan at parity, with Nepal and global markets trailing.

Data demonstrates clear patterns: smaller denomination packages typically offer better per-coin rates in low-cost regions, while bulk purchases show less dramatic regional variation.

Philippines: Most Cost-Effective Market

Philippine pricing establishes the benchmark for maximum coin value:

7,000 Coins: PHP 33 (≈$0.58) = 12,069 coins/$

21,000 Coins: PHP 99 (≈$1.74) = 12,069 coins/$

70,000 Coins: PHP 329 (≈$5.79) = 12,090 coins/$

210,000 Coins: PHP 989 (≈$17.40) = 12,069 coins/$

700,000 Coins: PHP 3,290 (≈$57.88) = 12,093 coins/$

3,500,000 Coins: PHP 22,450 (≈$394.96) = 8,862 coins/$

Data reveals consistent efficiency across small to medium packages, with notable drop in largest bundle. Optimal purchase points exist in the 700,000 coin range, where you maximize regional advantage before diminishing returns.

Current promotional periods from June 23 through October 31, 2025, offer 20% discounts on bundles of 21,000+ coins with minimum PHP 130 purchases, further enhancing arbitrage opportunity.

Nigeria and Pakistan: Competitive Alternatives

Nigeria and Pakistan maintain identical coins-per-dollar ratios, both delivering 9,460 coins per USD—matching global benchmark but falling short of Philippine efficiency:

Nigeria:

10,000 Coins: NGN 1,690 (≈$1.06) = 9,434 coins/$

100,000 Coins: NGN 16,900 (≈$10.56) = 9,470 coins/$

500,000 Coins: NGN 84,500 (≈$52.81) = 9,468 coins/$

1,000,000 Coins: NGN 169,000 (≈$105.63) = 9,467 coins/$

Pakistan:

10,000 Coins: PKR 2,960 (≈$1.06) = 9,434 coins/$

100,000 Coins: PKR 29,600 (≈$10.56) = 9,470 coins/$

500,000 Coins: PKR 148,000 (≈$52.81) = 9,468 coins/$

1,000,000 Coins: PKR 296,000 (≈$105.63) = 9,467 coins/$

These markets offer minimal advantage over global pricing, making them less attractive for arbitrage. However, users with existing payment infrastructure in these regions may find convenience value in local currency transactions.

Nepal: Mid-Tier Pricing

Nepal occupies middle ground between premium Philippine rates and global baseline, delivering ≈8,900 coins per dollar:

10,000 Coins: NPR 150 (≈$1.12) = 8,929 coins/$

100,000 Coins: NPR 1,650 (≈$12.33) = 8,110 coins/$

200,000 Coins: NPR 3,435 (≈$25.66) = 7,795 coins/$

500,000 Coins: NPR 8,435 (≈$63.02) = 7,933 coins/$

1,000,000 Coins: NPR 16,210 (≈$121.11) = 8,257 coins/$

Nepali pricing shows greater variance across package sizes, with smallest denomination offering best per-coin value. Users targeting Nepali pricing should focus on smaller, repeated purchases rather than bulk buying.

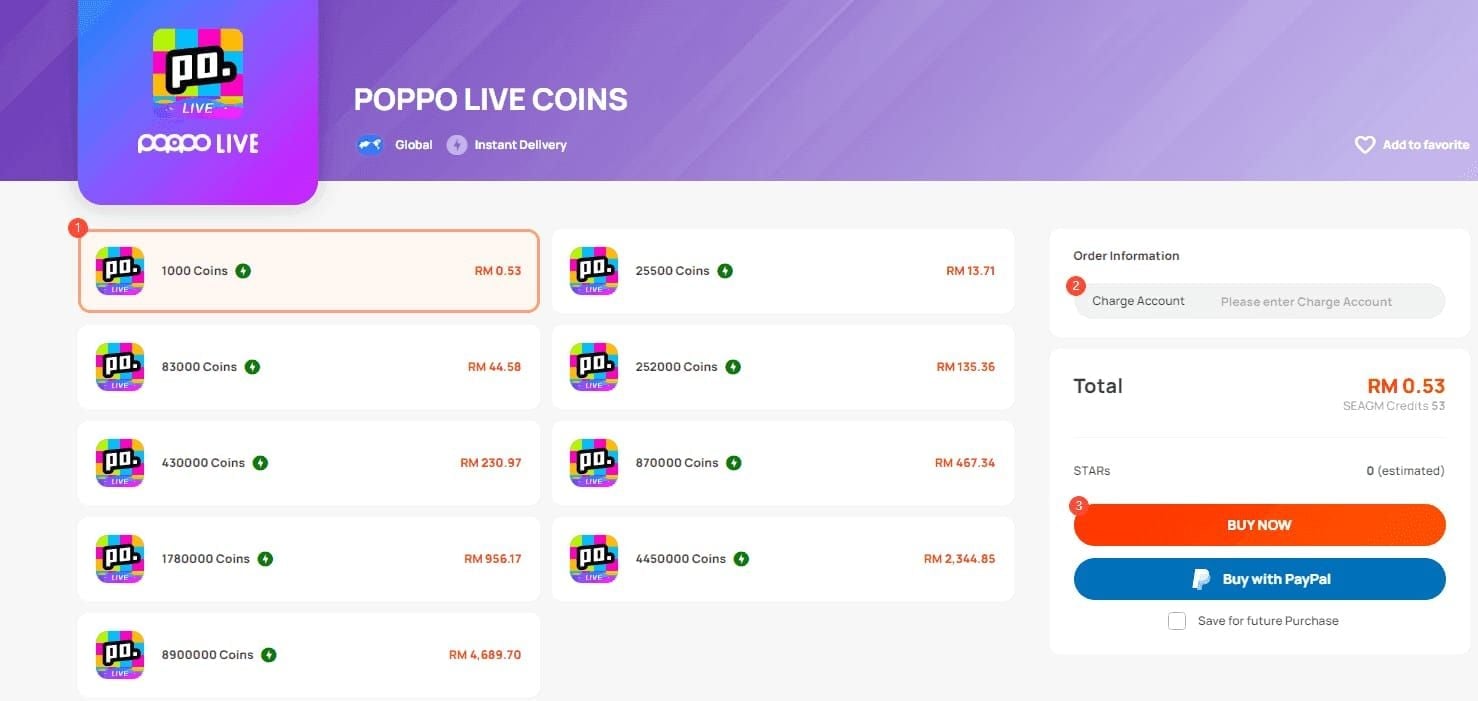

Global Market Baseline

Standard global pricing establishes the reference point:

83,000 Coins: $10 = 8,300 coins/$

252,000 Coins: $30 = 8,400 coins/$

430,000 Coins: $50 = 8,600 coins/$

870,000 Coins: $100 = 8,700 coins/$

1,780,000 Coins: $200 = 8,900 coins/$

4,500,000 Coins: $500 = 9,000 coins/$

9,100,000 Coins: $1,000 = 9,100 coins/$

Global pricing demonstrates progressive improvement with larger purchases, reaching 9,100 coins per dollar at $1,000 tier. This means bulk purchasers in global markets approach efficiency of mid-tier regional pricing, narrowing arbitrage advantage for high-volume transactions.

Real Savings Calculations

Translating regional price differences into concrete savings requires accounting for complete transaction cost.

Philippine Purchase (210,000 coins):

Base: PHP 989 (≈$17.40)

Foreign transaction fee (3%): $0.52

Currency conversion markup (2%): $0.35

Total: $18.27

Effective rate: 11,495 coins/$

Global Direct Purchase:

Nearest equivalent: 252,000 coins for $30

Adjusted for 210,000 coins: $25.00

No additional fees

Effective rate: 8,400 coins/$

Philippine route delivers 210,000 coins for $18.27 vs. $25.00 globally—net savings of $6.73 or 27% despite transaction fees. For monthly purchases, this translates to annual savings of ≈$80.76.

Users seeking to avoid transaction complexity while maintaining competitive pricing can explore recharge Poppo Coins agent services through BitTopup, which consolidates regional advantages into straightforward pricing without requiring VPN connections or international payment methods.

Small Package Optimization (Under 100,000 Coins)

Small denomination purchases show most dramatic regional advantages. For 70,000 coins:

Philippines:

Cost: PHP 329 (≈$5.79)

With fees: ≈$6.08

Rate: 11,513 coins/$

Global (83,000 coins, scaled to 70,000):

Cost: ≈$8.43

Rate: 8,300 coins/$

Philippine advantage delivers 38.7% more coins per dollar at this tier. Monthly purchases save ≈$28.20 annually through regional pricing.

Medium Package Analysis (100,000-500,000 Coins)

Medium-tier purchases represent the sweet spot for arbitrage efficiency:

Philippines (210,000 coins):

With fees: $18.27

Savings vs. global: $6.73 (27%)

Nigeria/Pakistan (200,000 coins):

With fees: $22.18

Savings vs. global: $2.82 (11%)

Nepal (200,000 coins):

With fees: $26.94

Savings vs. global: -$1.94 (premium of 8%)

At this tier, only Philippine pricing delivers meaningful savings after transaction costs.

Bulk Purchase Considerations (500,000+ Coins)

Large-volume purchases narrow regional advantage as global pricing improves with scale:

Philippines (700,000 coins):

With fees: $60.77

Rate: 11,518 coins/$

Global (870,000 coins, scaled to 700,000):

Cost: ≈$80.46

Rate: 8,700 coins/$

Philippine pricing maintains 32% advantage, saving $19.69. However, largest Philippine package (3,500,000 coins at $394.96) delivers only 8,862 coins/$—inferior to global $1,000 package at 9,100 coins/$.

Critical insight: beyond ≈1 million coins, regional arbitrage advantages diminish or disappear. High-volume purchasers may find better value in global pricing or specialized platforms offering bulk discounts.

Step-by-Step Regional Access Implementation

Accessing regional pricing requires either legitimate presence in target market or technical workarounds carrying varying degrees of platform policy compliance.

Method 1: VPN-Based Region Access

VPN access represents most common arbitrage method, though it explicitly violates Google Play terms of service:

Install reputable VPN service with servers in target country

Connect to Philippine server and verify IP shows Philippine location

Clear Google Play Store cache to force region detection refresh

Access Google Play Store and navigate to Poppo Live

Verify pricing displays in PHP before proceeding

Complete transaction using payment method accepting international charges

Disconnect VPN after purchase completion

Google increasingly detects VPN usage through signals beyond IP address, including device fingerprinting, payment method origin, and account history patterns. Accounts flagged for region manipulation may face purchase restrictions or suspension.

Method 2: Legitimate Regional Payment Methods

Users with genuine connections to low-cost regions can leverage local payment infrastructure without policy violations:

Philippine mobile wallets (GCash, PayMaya) linked to local bank accounts

Regional gift cards purchased through legitimate local retailers

Local credit/debit cards issued by banks in target country

Family/friend assistance from contacts residing in optimal pricing regions

This eliminates policy violation concerns but requires existing infrastructure or relationships in target markets.

Method 3: Specialized Recharge Platforms

Third-party recharge services consolidate regional pricing advantages into simplified purchasing experiences. BitTopup exemplifies this by:

Maintaining payment infrastructure across multiple regions

Offering transparent pricing reflecting regional advantages

Eliminating VPN requirements and technical complexity

Providing instant delivery with purchase protection

Supporting multiple payment methods without foreign transaction fees

This trades maximum theoretical savings for convenience, reliability, and policy compliance. Users avoid account risks while accessing better-than-global pricing.

Payment Method Strategies

Payment method selection significantly impacts net savings. Transaction fees, currency conversion rates, and payment processor markups can consume 5-10% of nominal savings.

Credit Card Considerations

International credit card purchases trigger multiple fee layers:

Foreign transaction fees: 1-3% (some cards waive this)

Currency conversion markup: 1-3% above mid-market rates

Dynamic currency conversion: Additional 3-5% if merchant offers pay in your currency

Premium travel credit cards often waive foreign transaction fees, immediately improving arbitrage economics by 1-3%. Always decline dynamic currency conversion—allow card network to handle conversion at more favorable rates.

Digital Wallet Optimization

PayPal:

Charges 3-4% currency conversion fee

May add foreign transaction fees

Generally unfavorable for international arbitrage

Regional Mobile Wallets (GCash, PayMaya):

No foreign transaction fees for local purchases

Competitive currency conversion if funding from international sources

Requires Philippine phone number and verification

Prepaid Card Solutions

Regional prepaid cards purchased through legitimate channels provide another access vector:

Philippine Google Play gift cards from authorized retailers

No foreign transaction fees when redeemed in correct region

Fixed exchange rate at time of card purchase

Requires VPN or regional account to redeem

This frontloads currency conversion but eliminates ongoing transaction fees. Purchase cards during favorable exchange rate periods and redeem later.

Risk Management and Account Security

Regional pricing arbitrage carries inherent risks. While individual consumer purchases rarely trigger enforcement, patterns suggesting commercial resale or systematic abuse attract platform attention.

Platform Policy Compliance Spectrum

Low Risk (Rarely Enforced):

Occasional purchases while traveling in different regions

Using legitimate payment methods from your actual location

Accessing content available in your home region

Medium Risk (Selective Enforcement):

Regular VPN usage to access different regional pricing

Frequent region switching on single account

Large-volume purchases inconsistent with account history

High Risk (Active Enforcement):

Commercial-scale purchasing for resale

Automated purchasing systems

Payment fraud or stolen payment methods

Multiple accounts from single device/payment method

Most individual users engaging in regional arbitrage fall into medium-risk category, where enforcement depends on volume, frequency, and whether activity triggers automated fraud detection.

Account Security Best Practices

Maintain consistent account information (don't frequently change registered country)

Use legitimate payment methods in your name

Avoid excessive region switching (pick one optimal region and stay consistent)

Keep purchase volumes reasonable relative to account history

Document legitimate reasons for regional access if questioned

Maintain backup accounts for critical access needs

Common Enforcement Triggers

Specific patterns tend to trigger platform review:

Rapid region changes: Switching between countries multiple times per day

Payment method mismatches: Philippine purchases with US-issued cards lacking international usage history

Volume inconsistencies: Sudden large purchases on previously inactive accounts

Multiple device access: Same account accessed from different countries simultaneously

Refund patterns: Frequent purchase-refund cycles suggesting testing or abuse

BitTopup Advantage: Simplified Access

Direct recharge platforms like BitTopup eliminate technical complexity and policy risks while maintaining competitive pricing advantages.

Transparent Pricing Without Regional Complexity

BitTopup consolidates regional pricing advantages into straightforward package offerings:

No VPN required

Clear USD pricing

Instant delivery (coins credited within minutes)

Multiple payment methods (credit cards, digital wallets, cryptocurrency)

No foreign transaction fees

This model maintains payment infrastructure across multiple regions and purchases in bulk at optimal regional rates, then passes savings to consumers through competitive package pricing.

Security and Reliability Advantages

No account policy violations

Purchase protection with refund policies and customer support

Payment security without exposing cards to international merchants

Consistent availability without VPN dependency

Clear transaction history for budgeting

Cost-Benefit Analysis: DIY vs. Platform

DIY Regional Arbitrage:

Maximum savings: 25-35%

Requires technical setup and maintenance

Policy violation risks

Time investment for each purchase

Best for: Tech-savvy users making large purchases

Platform Purchase (BitTopup):

Typical savings: 15-25% vs. global pricing

Zero technical requirements

No policy risks

Instant, simple transactions

Best for: Convenience-focused users, regular small purchases, risk-averse users

For monthly purchases under $50, time savings and risk elimination of platform purchases typically outweigh incremental savings from DIY arbitrage. High-volume users spending $200+ monthly may find DIY approaches worthwhile despite added complexity.

Advanced Optimization Strategies

Experienced users combine multiple optimization techniques to maximize long-term value.

Currency Timing Optimization

Exchange rate fluctuations create timing opportunities:

Monitor PHP/USD exchange rate using financial tracking tools

Purchase during peso weakness (higher PHP per USD = better coin rates)

Use gift cards to lock rates during favorable periods

Avoid purchases during peso strength

Philippine peso typically trades in 54-60 PHP/USD range, with 5-10% fluctuations over 3-6 month periods. Purchasing during 58 PHP/USD vs. 54 PHP/USD period gains ≈7% additional value.

Bundle Selection Strategy

Optimal Philippine Packages:

700,000 coins (PHP 3,290): 12,093 coins/$

210,000 coins (PHP 989): 12,069 coins/$

70,000 coins (PHP 329): 12,090 coins/$

Avoid:

3,500,000 coins (PHP 22,450): Only 8,862 coins/$

Strategic users purchase multiple medium-sized packages rather than single large packages when per-coin rate deteriorates at higher tiers.

Promotional Period Exploitation

Current promotional period (June 23-October 31, 2025) offering 20% discounts on 21,000+ coin bundles with minimum PHP 130 purchases creates stacking opportunities:

Base Philippine advantage: 12,069 coins/$

Promotional bonus: +20% coins

Combined rate: 14,483 coins/$

Savings vs. global: 59% improvement

Concentrate purchases during promotional windows, buying larger quantities to carry through non-promotional periods.

Monthly Budget Allocation

Regular spenders benefit from structured purchasing:

Calculate monthly coin consumption based on typical usage

Identify optimal package size minimizing per-coin cost

Set purchase schedule aligned with promotional periods and favorable exchange rates

Maintain 1-month buffer inventory to avoid emergency purchases at unfavorable rates

Track spending against budget to prevent overconsumption

Common Misconceptions

Myth: All Regional Purchases Violate Terms of Service

Reality: Legitimate purchases made while physically present in a region, using local payment methods, or through authorized third-party platforms don't violate platform policies. Violations occur when users deliberately misrepresent location to access pricing unavailable in their actual region.

Myth: VPN Usage Automatically Results in Account Bans

Reality: While VPN usage to manipulate pricing violates Google Play policies, enforcement is selective and primarily targets commercial-scale abuse. Individual users making occasional purchases rarely face account action, though risk exists.

Myth: Cheapest Region Always Offers Best Overall Value

Reality: Transaction fees, currency conversion costs, payment method limitations, and time investment can eliminate or reverse nominal price advantages. A region offering 15% lower base prices may cost more after accounting for 5% foreign transaction fees, 3% currency conversion markup, and 2% payment processor fees.

Myth: Bulk Purchases Always Provide Better Value

Reality: Regional pricing structures sometimes offer better per-coin rates on smaller packages. Philippine pricing shows this—the 3,500,000-coin package delivers only 8,862 coins/$ vs. 12,093 for the 700,000-coin package.

Future-Proofing Your Strategy

Regional pricing landscapes evolve as platforms adjust to market conditions, regulatory changes, and arbitrage exploitation.

Monitoring Regional Price Updates

Platforms periodically adjust regional pricing in response to:

Currency fluctuations: Major exchange rate movements trigger price recalibrations

Market conditions: Economic changes in specific regions prompt pricing reviews

Competitive pressure: New entrants or alternative platforms force price adjustments

Arbitrage exploitation: Excessive abuse may prompt platforms to narrow regional gaps

Track pricing across target regions monthly, documenting changes to identify trends.

Building Sustainable Long-Term Approaches

Most resilient coin purchasing strategies combine multiple methods:

Primary method: Lowest-risk approach for regular purchases (platform or legitimate regional access)

Opportunistic method: Higher-risk/higher-reward approach for large purchases during optimal conditions

Backup method: Reliable fallback when primary methods become unavailable

This diversified approach prevents complete disruption when any single method becomes unavailable or uneconomical.

When to Switch to Direct Purchase Platforms

Indicators suggesting transition from DIY arbitrage to platform purchases:

Time investment exceeds value

Risk tolerance decreases (account restrictions would create significant problems)

Purchase frequency increases (regular transactions make convenience more valuable)

Regional advantages narrow (platform pricing approaches DIY arbitrage results)

Technical complexity increases (enhanced detection requires more sophisticated workarounds)

Calculate effective hourly return from arbitrage activities, including setup time, purchase execution, and troubleshooting. When this rate falls below your personal value of time, platform purchases become economically rational even at slightly higher per-coin costs.

Frequently Asked Questions

Which country has the cheapest Poppo Live coins on Google Play?

Philippines offers cheapest Poppo Live coins, delivering ≈12,000+ coins per $1 USD—significantly better than Nigeria and Pakistan (9,460 coins/$), Nepal (8,900 coins/$), and global markets (8,300-9,100 coins/$). The 700,000-coin package at PHP 3,290 (≈$57.88) provides optimal per-coin rate at 12,093 coins/$.

How much can I save using exchange rate arbitrage on Poppo Live?

Savings range from 25-35% depending on package size and transaction costs. Purchasing 210,000 coins through Philippine pricing costs ≈$18.27 (including fees) vs. $25.00 through global pricing—saving $6.73 per transaction or 27%. Monthly purchasers save ≈$80-100 annually.

Is it legal to buy Poppo coins from different countries?

Purchasing through legitimate regional payment methods while physically present in a region is legal. However, using VPNs to misrepresent location and access different regional pricing violates Google Play terms of service, though it doesn't constitute illegal activity in most jurisdictions. Platforms may restrict accounts for policy violations. Third-party platforms like BitTopup provide policy-compliant access to competitive pricing.

What payment methods work best for international Poppo coin purchases?

Credit cards without foreign transaction fees (typically premium travel cards) offer best combination of convenience and cost-effectiveness, adding only 1-2% in currency conversion costs. Regional mobile wallets like GCash or PayMaya eliminate foreign transaction fees entirely but require local verification. Prepaid Google Play gift cards purchased in target regions avoid ongoing transaction fees but require VPN access for redemption.

Can I get banned for buying Poppo coins from another region?

Account restrictions are possible but uncommon for individual users making occasional purchases. Platforms primarily enforce against commercial-scale abuse, automated purchasing systems, and patterns suggesting resale operations. Risk increases with frequent region switching, large-volume purchases inconsistent with account history, and payment method mismatches. Using legitimate third-party platforms eliminates this risk.

Does BitTopup offer better prices than Google Play regional stores?

BitTopup pricing typically falls between optimal regional pricing (Philippines) and global Google Play rates, offering 15-25% savings vs. global pricing. While maximum DIY arbitrage can achieve 25-35% savings, BitTopup eliminates VPN requirements, foreign transaction fees, policy violation risks, and technical complexity. For users valuing convenience and security, BitTopup's competitive pricing with instant delivery and purchase protection provides superior overall value.