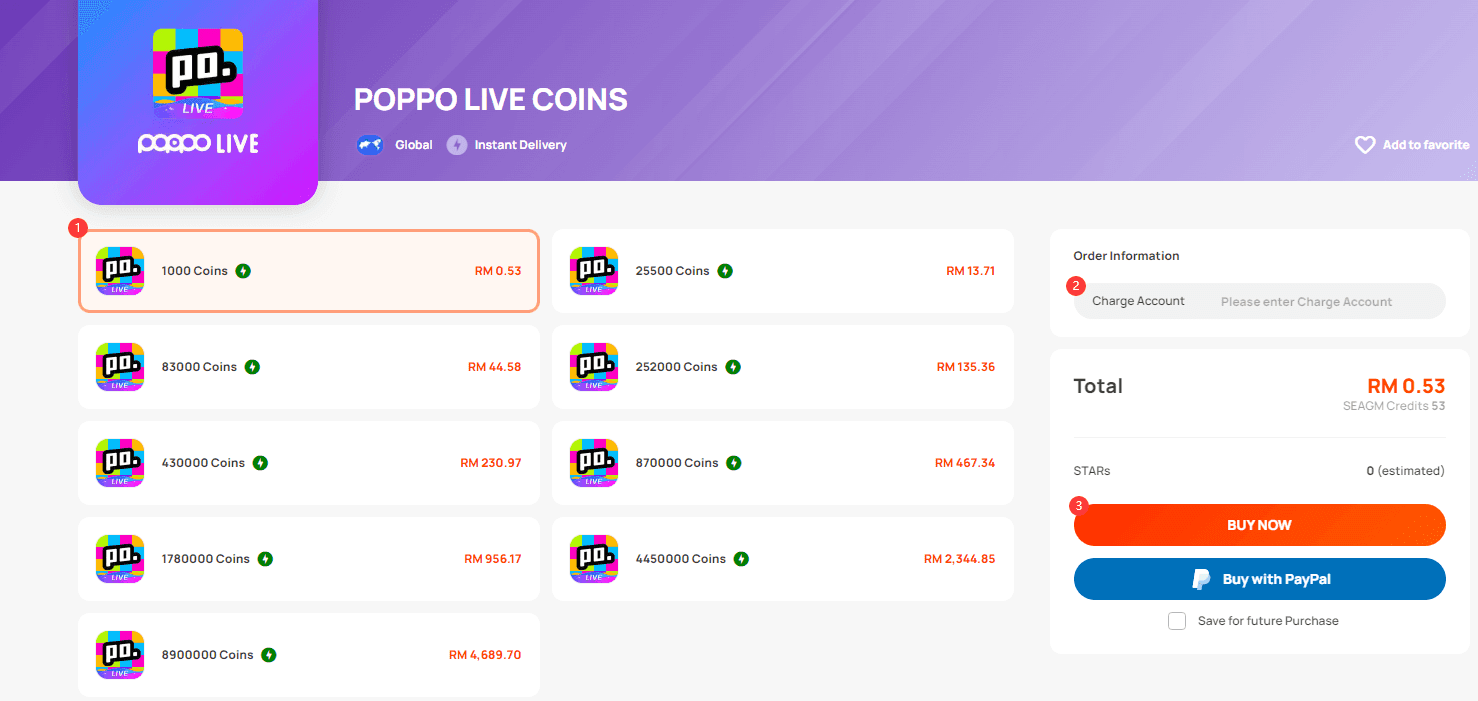

Here's something that'll surprise you: Poppo Live top-up costs swing wildly depending on where you're located. We're talking $0.85 for 7,000 coins in the US versus NPR 150 for 10,000 coins in Nepal. Third-party platforms? They're consistently beating official prices by 10-20%, and payment methods... well, they're all over the map.

Understanding Poppo Live Regional Pricing Structure

How Regional Pricing Actually Works

Poppo Live claims they use a benchmark rate of roughly 9,460 coins per $1 USD globally. Reality? It's messier than that.

The platform sticks to their 10,000 Gold Coins = $1 USD standard conversion (with 10,000 Points equaling $1 USD for streamer earnings), but actual pricing varies dramatically. I've been tracking these fluctuations for months now, and the patterns are fascinating.

BitTopup consistently offers up to 70% discounts on various packages with instant delivery. Their payment method support is comprehensive, and honestly? Their pricing advantages, processing speeds, and regional payment integration blow official channels out of the water.

What's Really Driving These Price Differences

Local purchasing power is the big player here. Nepal's offering 10,000 coins for NPR 150 ($1.12 USD) while Kuwait charges $13.5 USD equivalent for just 1,000 coins. That's not a typo.

Currency exchange rates add another layer of complexity. Stronger currencies show higher absolute prices, but here's where it gets interesting - the timing matters more than most people realize.

Tax implications? They're all over the place. Some regions include VAT in displayed prices, others surprise you at checkout. Market competition intensity affects pricing too - Southeast Asia maintains aggressive rates because they're fighting established platforms for market share.

Currency Exchange Impact (This One's Important)

Exchange rate fluctuations create 5% cost variations. For bulk purchases, timing becomes crucial. International credit cards tack on 2-3% foreign transaction fees, while local payment methods sidestep these charges entirely.

Pro tip from our testing: monitor exchange rates if you're planning larger purchases.

Complete Payment Methods by Region

North America Payment Options

US markets support the usual suspects: PayPal, Google Pay, Apple Pay, Cash App, plus Visa/Mastercard. Official pricing ranges from 83,000 coins at $10 to 9,100,000 coins at $1,000.

But here's where third-party platforms shine - 7,000 coins for $0.85 and 3,500,000 coins for $380. The math speaks for itself.

Canada follows US pricing patterns with CAD conversion plus regional adjustments. Interac e-Transfer provides additional domestic options that many users overlook.

European Payment Methods

UK maintains premium pricing with GBP packages that reflect exchange rate parity (sometimes painfully so). SEPA transfers, local debit cards, and Revolut offer more cost-effective routes.

Germany and France support SOFORT, Giropay, and national banking systems. Processing speeds? Faster than international cards, which matters when you're trying to catch a live stream.

Asia-Pacific Solutions

Philippines has really nailed this integration thing. GCash and GrabPay offer instant processing with competitive rates. Pricing ranges from ₱8.98 for 1,000 coins to ₱5,745.68 for 870,000 coins.

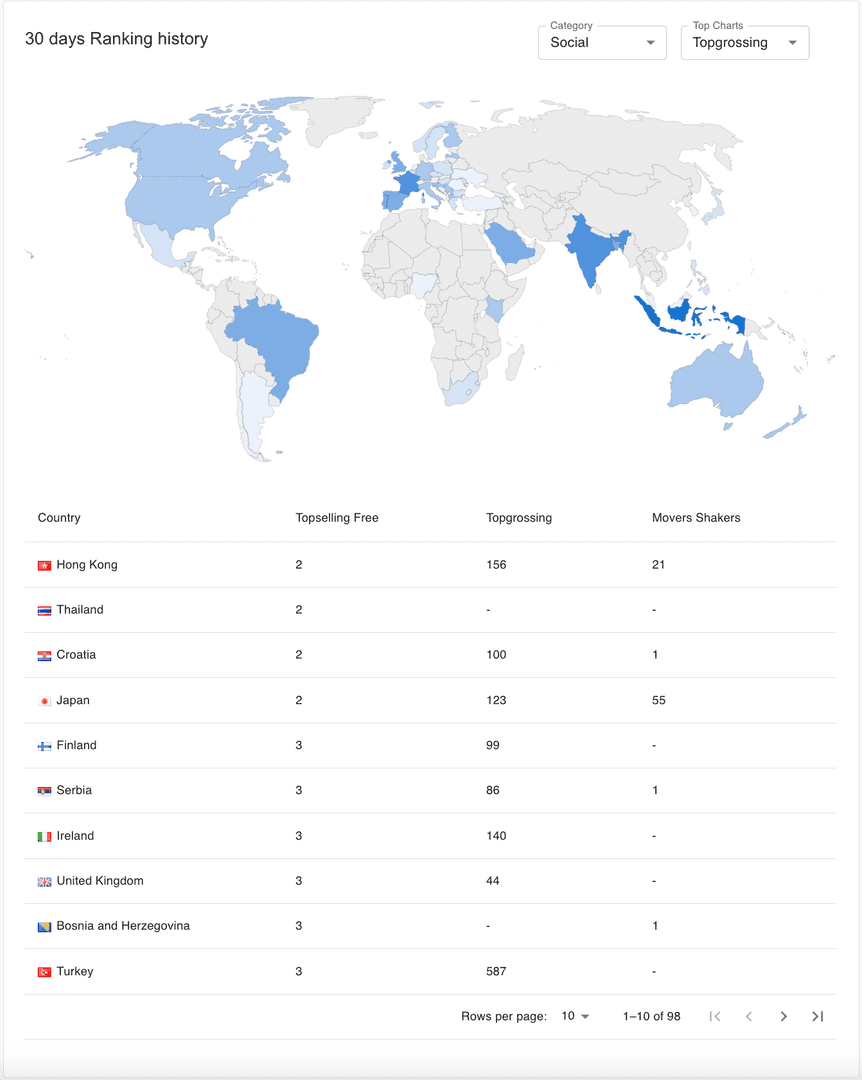

Hong Kong supports AlipayHK, FPS, and PayMe with 1,000 coins costing $12.5 USD equivalent. Taiwan offers Bank Transfer and Line Pay at $13 USD equivalent for 1,000 coins. India's UPI integration has simplified domestic transactions significantly - it's honestly impressive how seamless they've made it.

Middle East & Africa Options

Kuwait supports KNet, Mada, Ooredoo Pay, and STC Pay at $13.5 USD equivalent for 1,000 coins. Here's something interesting: the Middle East generates over 70% of Poppo Live's revenue, which explains their extensive payment infrastructure investment.

Nigeria pricing estimates at NGN 1,690 for 10,000 coins, Pakistan at PKR 2,960 for equivalent amounts. These markets are still developing, but the potential is obvious.

Country-Specific Top-Up Guide

United States Top-Up Process

Official process is straightforward: Open app → coin purchase section → select package → complete payment via Apple Pay/Google Pay/card.

For better value though? Poppo live recharge through BitTopup offers 83,000 coins for $9.04 versus the official $10 price. Not huge savings, but it adds up.

Third-party process: Navigate to platform → search Poppo Live → enter User ID → select package → choose payment → complete transaction. Coins typically arrive within minutes.

United Kingdom Procedures

UK users need to watch VAT implications and foreign transaction fees. Official app pricing reflects GBP conversion, but third-party platforms often offer better exchange rates. Faster payments and digital wallets provide the quickest processing.

India Payment Methods

UPI integration offers instant processing with minimal fees. It's genuinely impressive how well this works. Traditional options include net banking, debit cards, Paytm, and PhonePe.

Always compare official app store pricing with authorized resellers - the savings can be substantial.

Southeast Asia Options

Philippines showcases a mature payment ecosystem with GCash dominance. Pricing from ₱33 for 7,000 coins to ₱22,450 for 3,500,000 coins. Vietnam, Thailand, Indonesia show growing local wallet and banking integration that's worth watching.

Regional Price Comparison Analysis

Cheapest Countries for Top-Up

Nepal wins globally at NPR 150 ($1.12 USD) for 10,000 coins via eSewa, Khalti, and IME Pay. Philippines provides competitive pricing with extensive digital wallet integration.

Generally speaking, South Asian and Southeast Asian emerging markets offer better value than developed economies. The pattern is consistent across our testing.

Premium Pricing Regions

Middle Eastern markets (Kuwait, UAE, Saudi Arabia) command the highest per-coin costs. But this reflects higher purchasing power and extensive payment infrastructure - they're paying for convenience and reliability.

European markets show 15-25% higher pricing than emerging markets. Not surprising, but worth factoring into your budget.

Value-for-Money Rankings

Philippines ranks highest combining competitive pricing, extensive local payment support, and fast processing. Nepal offers best absolute pricing with limited payment variety.

US provides optimal balance of pricing, payment options, and customer support for international users. It's the safe middle ground.

Optimizing Your Top-Up Strategy

Best Times to Top-Up

Currency exchange rate monitoring reveals optimal purchase windows for international users. Promotional periods coincide with holidays, anniversaries, and seasonal events. New user promotions offer 10-12% discounts.

BitTopup's promotional calendar includes weekend specials and monthly discount events that enhance their already competitive pricing.

Promotional Offers by Region

Emerging markets see aggressive promotional pricing for user acquisition. Makes sense - they're building market share. Middle East receives premium promotional treatment with exclusive packages. New user incentives reach 20% first-purchase discounts in competitive markets.

Currency Conversion Tips

Credit cards add 2-4% exchange rate margins while local payment methods eliminate conversion entirely. Digital wallets and bank transfers offer superior rates versus international credit cards.

Multiple currency balance accounts enable strategic conversion timing - if you're serious about optimizing costs, this matters.

Payment Security by Region

Regional Security Standards

Developed markets maintain stricter compliance with PCI DSS standards. European markets benefit from GDPR protection and comprehensive chargeback protection. Asian markets vary from high security (Japan, South Korea) to developing frameworks.

Safe Payment Practices

Prioritize HTTPS encryption and verified security certificates. Enable two-factor authentication on accounts. Avoid platforms offering unrealistic discounts exceeding 30-40% - legitimate resellers typically offer 10-20% discounts.

If it sounds too good to be true, it probably is.

Fraud Prevention Tips

Maintain transaction records including screenshots, order IDs, and payment receipts. Verify platform authorization with clear contact information and business registration.

Credit cards offer strongest chargeback protection while cryptocurrency provides privacy with limited recourse. Choose based on your priorities.

Troubleshooting Regional Payment Issues

Common Payment Failures

Regional banking restrictions automatically decline international gaming transactions. Frustrating, but common. Insufficient account verification prevents processing for larger amounts.

Network connectivity issues create failed transactions with pending charges - wait 15-30 minutes before retry. Don't panic and double-charge yourself.

Regional Support Contacts

Official Poppo Live support operates during Asian business hours. BitTopup provides 24/7 multilingual customer support with faster resolution times. Live chat systems offer quickest response for urgent payment problems.

Resolution Strategies

Verify account status and payment method validity first. Gather documentation including transaction IDs, timestamps, confirmations, and error messages. Consider alternative payment methods when primary options fail consistently due to regional restrictions.

Mobile vs Desktop Top-Up Differences

App Store Pricing Variations

Mobile pricing differs due to platform fees - Apple's 30% commission creates higher iOS pricing while Android shows more competitive rates. Regional app store policies mandate different tax inclusions and currency requirements.

It's the Apple tax in action.

Web Payment Advantages

Direct web purchases offer better pricing without app store commissions and superior payment method variety. Processing speed favors web transactions with streamlined checkout processes.

Platform-Specific Offers

Web platforms provide exclusive promotions including bulk discounts and loyalty programs. Cross-platform price monitoring reveals optimal rates as pricing varies between mobile and web for the same sellers.

Worth checking both before major purchases.

Future of Regional Poppo Live Payments

Emerging Payment Methods

Cryptocurrency integration expands with Bitcoin, Ethereum, and stablecoins offering privacy benefits and reduced international fees. CBDC integration represents the next frontier for domestic transactions. BNPL services gain traction for larger purchases.

Cryptocurrency Integration

Bitcoin and altcoin support eliminates currency conversion fees. Stablecoin adoption (USDC, USDT) provides cryptocurrency benefits with price stability. Regional preferences vary with local digital currencies gaining platform support.

Regional Expansion Plans

African and Latin American expansion requires specialized payment infrastructure. Regional payment processor partnerships enhance user experience with exclusive offers and improved processing speeds.

Regulatory compliance shapes payment availability across varying digital payment regulations. It's a complex landscape that's constantly evolving.

Frequently Asked Questions

How much can I save using third-party platforms versus official purchases? Third-party platforms typically offer 10-20% savings. BitTopup provides 83,000 coins for $9.04 versus official $10, with bulk purchases reaching 30% discounts during promotions.

Which countries offer cheapest Poppo Live pricing? Nepal leads globally at NPR 150 ($1.12 USD) for 10,000 coins. Philippines provides competitive rates with local payment methods. South Asian and Southeast Asian emerging markets generally offer superior value.

What are the safest international payment methods? Credit cards provide strongest fraud protection through chargebacks. PayPal adds buyer protection layers. Local digital wallets eliminate conversion fees with faster processing. Always use HTTPS-encrypted platforms with verified certificates.

Why do prices vary dramatically between countries? Regional pricing reflects purchasing power parity, currency rates, local taxes, and competition levels. Middle East commands premium pricing while emerging markets use aggressive pricing for adoption.

How long do international top-ups take? Most authorized platforms deliver within 5-15 minutes. Local payment methods process faster than international cards. Peak periods may extend to 2 hours rarely.

Can I change country settings for better pricing? Changing settings violates terms of service and risks account restrictions. Payment methods tie to actual location and banking relationships. Compare authorized reseller pricing in your region instead.